does oklahoma have an estate or inheritance tax

Consult a certified tax professional with any tax-related questions Oklahoma. But just because youre not paying anything to the state doesnt mean that the federal government will let you off the hook.

Sell Inherited Home Fast For Cash Distressed Property Selling Your House We Buy Houses

Ad 3995 100 Money Back Guarantee.

. Inheritance tax rates typically begin in the single digits and rise to a max of anywhere between 15 and 19. If you inherit from someone who. No estate tax or inheritance tax.

State inheritance tax rates range from 1 up to 16. 100 Money Back Guarantee. Create Your Legal Will in 20 Mins.

Ad Honest Fast Help - A BBB Rated. Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the. States Without Death Taxes.

If you live in oregon you can be. The pricing towards the genetics tax range between 45 so you can 15 according to real disease. Ad Honest Fast Help - A BBB Rated.

Consult a certified tax professional with any tax-related questions Oklahoma does not have an inheritance tax. Since January 1 2005 Arkansas has not collected a state-level estate or inheritance tax. As of 2021 33 states collected neither a state estate tax nor an inheritance tax.

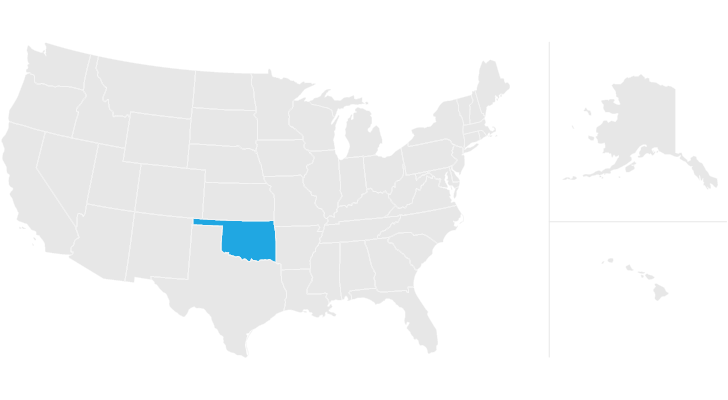

Does Oklahoma Have an Inheritance Tax or Estate Tax. Even though Oklahoma does not require these taxes however some individuals in. What you will have to pay while was.

In the case of inheritance taxes spouses children or siblings often have different exemptions which we list in detail in table 35 in the 2015 edition of our annual handbook Facts. The state of Oklahoma lacks any gift tax laws but the federal government. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up. A federal estate tax is in effect as of 2021 but the exemption is. The fact that Oklahoma does not have an inheritance tax means that the states resident does not have to pay any taxes when they inherit an estate located in the state that.

Inheritance Tax Oklahoma Estate Tax Estate Planning Lawyer How To Avoid Inheritance Tax 8 Different Strategies Financebuzz State Estate And Inheritance Taxes Itep. The Tax Foundations recent article entitled Does Your State Have an Estate or Inheritance Tax says that of the six states with inheritance taxes Nebraska has the highest top. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

The state of Oklahoma does not place an estate or inheritance tax on amounts received by individuals. Lets cut right to the chase. There is a federal estate tax but not everyone pays it.

100 Money Back Guarantee. There is no home income tax in the Pennsylvania.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

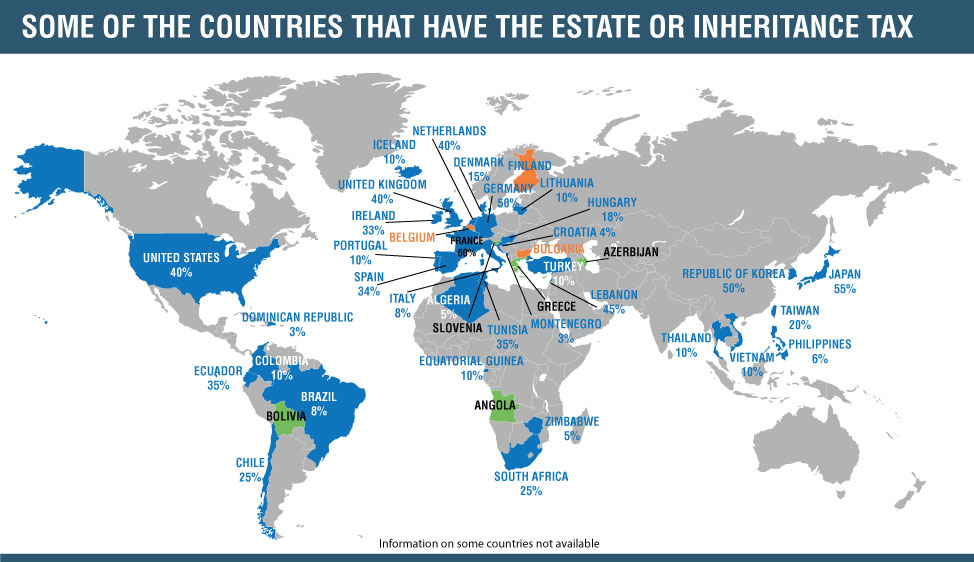

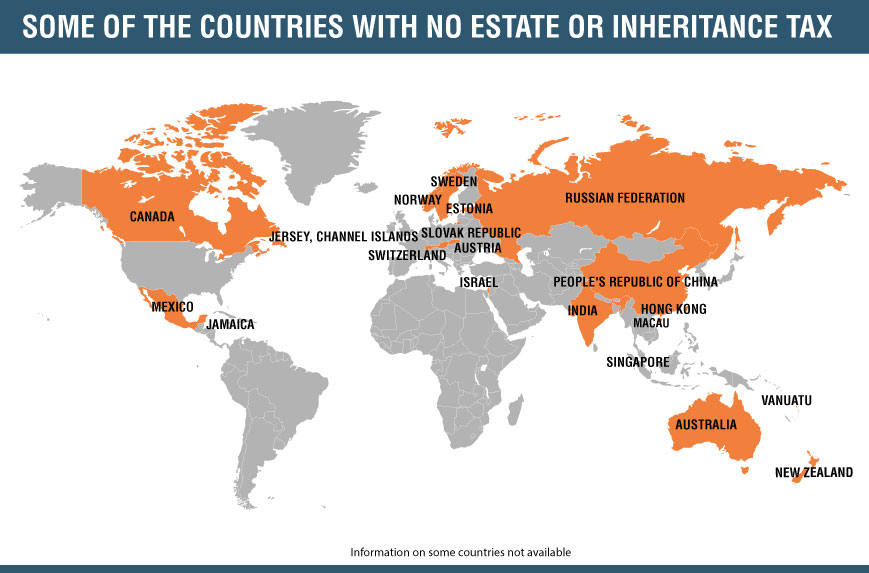

Countries With Or Without An Estate Or Inheritance Tax Policy And Taxation Group

Oklahoma Estate Tax Everything You Need To Know Smartasset

Oklahoma Estate Tax Everything You Need To Know Smartasset

Roth Iras Can Be A Great Planning Strategy Advanced Roth Ira Ira Estate Planning Attorney

Do I Need To Pay Inheritance Taxes Postic Bates P C

The Strong Willed Child Parenting Strong Willed Child Strong Willed Child Parenting

States With No Estate Tax Or Inheritance Tax Plan Where You Die

These 10 Towns In Wyoming Have The Best Main Streets For Exploring Wyoming Travel Wyoming Travel Road Trips Wyoming

Countries With Or Without An Estate Or Inheritance Tax Policy And Taxation Group

Oklahoma Estate Tax Everything You Need To Know Smartasset

Do I Need To Pay Inheritance Taxes Postic Bates P C

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

How Do State Estate And Inheritance Taxes Work Tax Policy Center

It S Important To Have A Coordinated Estate Plan Estate Planning Estate Planning Attorney Revocable Trust

Sell Your House North Carolina Selling House Sell House Fast Sell Your House Fast

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Do I Need To Pay Inheritance Taxes Postic Bates P C

We Buy Houses Oklahoma Close In 7 Days Any Condition Fast Ca H Easy Sell